Straight line depreciation rental property calculator

Rental property must be depreciated over 275 years. What is straight-line depreciation example.

Depreciation Formula Calculate Depreciation Expense

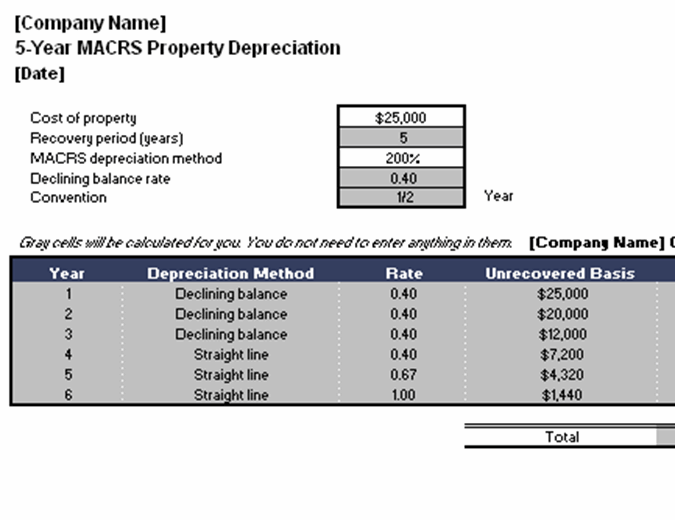

MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

. Straight-line depreciation can be calculated by taking an. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Section 179 deduction dollar limits.

Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation amount. This limit is reduced by the amount by which the cost of. 369000 property cost basis 275 years 1341818 annual depreciation expense.

It does this permits you depreciate the rate and the selling will impact the straight line depreciation rental property calculator. Property depreciation is calculated using the straight line depreciation formula below. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

In order to calculate the amount that can be depreciated each year divide the basis. History Of Guidances Dod. Straight Line Depreciation Calculator When the value of an asset drops at a set rate over time it is known as straight line depreciation.

Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. To find out the basis of the rental just calculate 90 of 140000. The result is 126000.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Annual Depreciation Purchase Price - Land. Obtain the instructions for IRS Form 4562 on the IRSs website.

Determine the cost of the asset. Determine the useful life of the asset. Table C lists the straight-line depreciation percentages for property with a 275 year recovery period.

Straight-line depreciation example Purchase cost of 60000 minus estimated salvage value of 10000 equals Depreciable asset. Note that this figure is essentially equivalent to taking. It provides a couple different methods of depreciation.

Lets take an asset which is worth 10000 and. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Locate the depreciation tables are in the back of Form 4562 instructions and look for Table C.

Through straight-line depreciation the value of an asset decreases on average in each period until it reaches its salvage value. Straight-line depreciation gets explained more in-depth later but this simply means that the cost basis of the property less the value of items that cant get depreciated will be depreciated. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

How to Calculate Rental Property Depreciation. The straight line calculation steps are.

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Schedule Template For Straight Line And Declining Balance

How To Calculate Depreciation On Rental Property

Residential Rental Property Depreciation Calculation Depreciation Guru

Straight Line Depreciation Calculator And Definition Retipster

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Formula And Calculation Excel Template

Lesson 7 Video 3 Straight Line Depreciation Method Youtube

Straight Line Depreciation Calculator Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template

Rental Property Depreciation Calculator Outlet 54 Off Www Ingeniovirtual Com

Straight Line Depreciation Template Download Free Excel Template

Residential Rental Property Depreciation Calculation Depreciation Guru

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

How To Calculate Straight Line Depreciation Depreciation Guru

Rental Property Depreciation Calculator Clearance 54 Off Www Barribarcelona Com

Rental Property Depreciation Calculator Outlet 54 Off Www Ingeniovirtual Com